All peer-to-peer lending (P2P) firms will be treated as non-banking financial companies (NBFCs).

These firms will be regulated by the Reserve Bank of India (RBI).

BCP and back up for the data needs to be put in place since the platform also acts as a custodian of the agreements/cheques etc.

These firms will be regulated by the Reserve Bank of India (RBI).

Proposed Regulatory Framework by RBI

- The Reserve Bank of India published a Consultation Paper on Peer-to-Peer Lending on April 28, 2016 in which following framework to regulate P2P firms as NBFCs was given:

- It proposed to bring the P2P lending platforms under the purview of RBI's regulation by defining P2P platforms as NBFCs under section 45I(f)(iii) of the RBI Act by issuing a notification in consultation with the Government of India.

Permitted Activity

- The platform will be required to ensure that section 45S of the RBI Act is not attracted by its activities.

- The platforms will be prohibited from giving any assured return either directly or indirectly.

- The platforms will be allowed to opine on the suitability of a lender and creditworthiness of a borrower.

- It will also be mandated that funds will have to necessarily move directly from the lender’s bank account to the borrower’s bank account to obviate the threat of money laundering.

- The guidelines would also prohibit the platforms being used for any cross-border transaction in view of FEMA provisions relating to transactions between residents and non-residents.

Prudential Requirements

- The prudential requirements will include a minimum capital of Rs 2 crore.

- Leverage ratio may be prescribed so that the platforms do not expand with indiscriminate leverage. Tthe lenders may include uninformed individuals, prudential limits on maximum contribution by a lender to a borrower/segment of activity could also be specified.

Governance Requirements

A reasonable proportion of board members having financial sector background could be suggested. The guidelines may also require the P2P lender to have a brick and mortar place of business in India. The management and operational personnel of the platform would need to be stationed within the country.Business Continuity Plan (BCP)

The platforms need to put in place adequate risk management systems for its smooth operations.BCP and back up for the data needs to be put in place since the platform also acts as a custodian of the agreements/cheques etc.

Customer Interface

- Confidentiality of the customer data and data security would be the responsibility of the Platform. Transparency in operations, adequate measures for data confidentiality and minimum disclosures to borrowers and lenders would also be mandated through a fair practices code.

- The current regulations applicable to other NBFCs will be made applicable to the P2P platforms in regard to recovery practice.

- The operators would also be mandated to have a proper grievance redress mechanism to deal with complaints from both lenders and borrowers and require reporting to the Board.

Reporting Requirements

- The platforms will need to submit regular reports on their financial position, loans arranged each quarter, complaints etc. to the Reserve Bank.

- The Bank may come out with a detailed reporting requirement.

What is P2P Lending Firms?

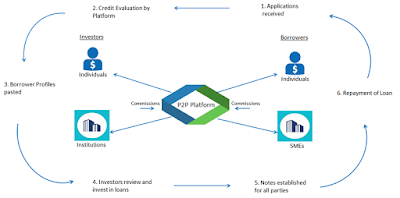

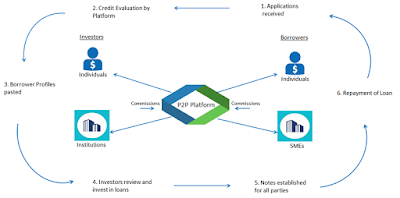

- Peer-to-peer lending, sometimes abbreviated P2P lending, is the practice of lending money to individuals or businesses through online services that match lenders with borrowers.

- Lenders can earn higher returns compared to savings and investment products offered by banks

- It is also known as crowdlending

- Many peer-to-peer loans are unsecured personal loans, though some of the largest amounts are lent to businesses.