- Following are the decisions taken by the central bank in the meeting:-

- The RBI’s MPC has decided to keep the repo rate unchanged at 4% and the reverse repo rate stands at 3.35%.

- The MSF (Marginal Standing Facility) rate is kept unchanged at 4.25% and the bank rate is also kept unchanged at 4.25%.

- The real GDP growth for 2021-22 is projected at 10.5%.

- There are revised projections for CPI (Consumer Price Index) inflation to 5% in Q4 of 2021, 5.2%, in Q1 of 2021-22, 5.2% also in Q2 of 2021-22, 4.4% in Q3, and 5.1% in Q4 with risks broadly balanced.

- The inflation target was retained at 4% earlier on March 31, 2021, with a lower tolerance level of 2% and upper tolerance level of 6% for the next 5 years i.e. from April 2021 to March 2026.

- Also, to ensure adequate liquidity in the system so that the sectors get adequate credit, the central bank has decided to have fresh lending of Rs 50,000 to all Indian financial institutions.

- The RBI has announced to increase the centre’s Ways and Means Advances by 46% with the current limit of Rs 32,225 crores, which is thus increased to Rs 47,010 crores.

- Also, RBI has announced that prepaid payment instruments and white label ATMs which are regulated by the RBI can now take up direct membership in NEFT and RTGS.

- Static Part:

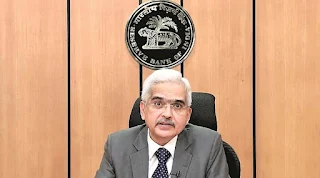

- HQ of RBI: Mumbai

- Governor of RBI: Shaktikanta Das

Question:

Q.1 As per the RBI’s bi-monthly monetary policy meeting held by MPC in April 2021, what is the MSF (Marginal Standing Facility) rate value?

a. 4%

b. 4.25%

c. 3.35%

d. 3.75%

a. 4%

b. 4.25%

c. 3.35%

d. 3.75%